“I found the team at Settld extremely helpful, empathetic and efficient in the resolution of my late mother’s affairs. I would strongly recommend Settld as a service that takes away a significant element of the administrative work associated with dealing with a bereaved estate at a time when you need it the most.”

Settld user

Using Settld, you only need to provide information once

A simple service

On a single form, you can list all the companies you need to notify, upload the information that they will need to proceed, and detail what should happen to each account.

A transparent process

We will notify all of the companies you’ve listed, at the same time, and we’ll follow up delays on your behalf. We’ll make sure you’re always updated, and we’ll let you know when everything you’ve requested has been completed.

You can check progress online at any time and we’re always here to help if you need us.

Settld is a secure service

Data encrypted at transit

Data encrypted at rest

Multi factor authentication

Data stored in ISO27001 certified UK data centres

Common Questions and Answers

A grant of probate confirms the authority of an Executor to administer and distribute the estate of someone who has died. If there was no will, you’ll apply for letters of administration instead.

Yes. Our Free Account Support service includes notifying companies of a death, stopping post and instruction for account closure, transfer or freeze. You can upgrade later if we determine that probate is required.

If the Estate is not being passed to a surviving spouse, a home is being sold, there are financial accounts worth a significant amount or there are stocks and shares, it is likely that Probate will be required.

If you are unsure whether you need Probate, speak to a member of our specialist team today.

You will probably not have to apply for Probate if any one of these conditions apply to the estate:

- Joint assets Only: If the estate is worth less than £1 million and is being passed to a spouse, civil partner, or charity

- Less than £5,000: The value of everything that the deceased owned in their own name is worth less than £5,000: or

- There were only savings and no other assets such as property, vehicles etc.

Provided that you are either named as an Executor, or you have permission from the other next of kin, you can distribute the assets according to the wishes of the deceased.

Sometimes financial services firms will insist that you apply for probate before allowing you to access funds . This will depend on the value of the account and ranges from £5,000 – £50,000 by provider. Settld can check with individual providers on your behalf as part of our service.

Yes. The first step in applying for a grant of probate (or letters of administration) is to contact all relevant organisations about the death, to gather the documentation on assets and debts. You can do this yourself, which means contacting all companies individually (often by phone), filling in multiple forms and sending off documents. Alternatively, a Probate Solicitor can do the same job for you. Whoever does the job, it’s usually around 20 hours of admin effort.

In order to comply with your duties as Executor, you are required to value the Estate for inheritance tax, including estimating the value at date of death of any savings and investments, property, debts and other liabilities. You will then be required to either complete the requisite Inheritance Tax (IHT) forms and pay any tax owing or certify that you are applying for ‘Excepted Estate’ status. Settld can help identify all assets and debts as we manage correspondence with Service Providers to obtain date of death balances.

For the time being some Service Providers choose to handle correspondence by post. Once they process our notification, they will contact you directly with next steps and information. Many companies will get back within 10 working days.

Typical solicitors charge ~£30 per company they engage with (“per letter”). Given that most people leave behind a minimum of 15 accounts, this can mean a legal fee of £450.

Aside from Settld’s fee, there’s a Probate registry fee of £273 and copies of the Grant of Probate cost £1.50 each. Some financial institutions require sealed court copies of the Grant to release funds from the Estate. Settld can also help to estimate the number of copies of the Grant you will need. You may also opt to place a Deceased Estate Notice in The Gazette to avoid being personally liable for any Estate creditors that come forward at a later date. The cost of advertising starts from about £80.

Using Settld, you only need to provide your details and documents once, using one form. As companies respond to Settld, you will see an update on your personal accounts dashboard, showing the status of each account and any associated documents. Until the account is ‘Settld’ according to your demand (closed, amended or transferred), and information obtained, the account will be shown in pending status.

Settld currently notifies over 950 different organisations. These include financial services (banks, building societies, credit card companies, pension providers and insurers), household services (utilities, TV, phone, broadband), digital services (social media, digital entertainment, online shopping), and others (club memberships, donations to charities). See a list of the companies we contact here.

We will always do our best to notify and streamline the communication with each Service Provider on your behalf, but there may be some companies that still ask to speak with you. In those instances, we will hand over the communication and remain on hand to help if needed.

Settld makes it quick and easy to send out notifications and tell companies how you would like the account to be handled (closed, amended or transferred). However, each Service Provider has its own internal systems and processes to follow. You can generally expect it to take up to 2 weeks to turn around most account requests, but some Service Providers might take longer (normally financial institutions). Settld will follow up with the companies for updates on your behalf, so you do not need to sit on call lines or keep on top of emails.

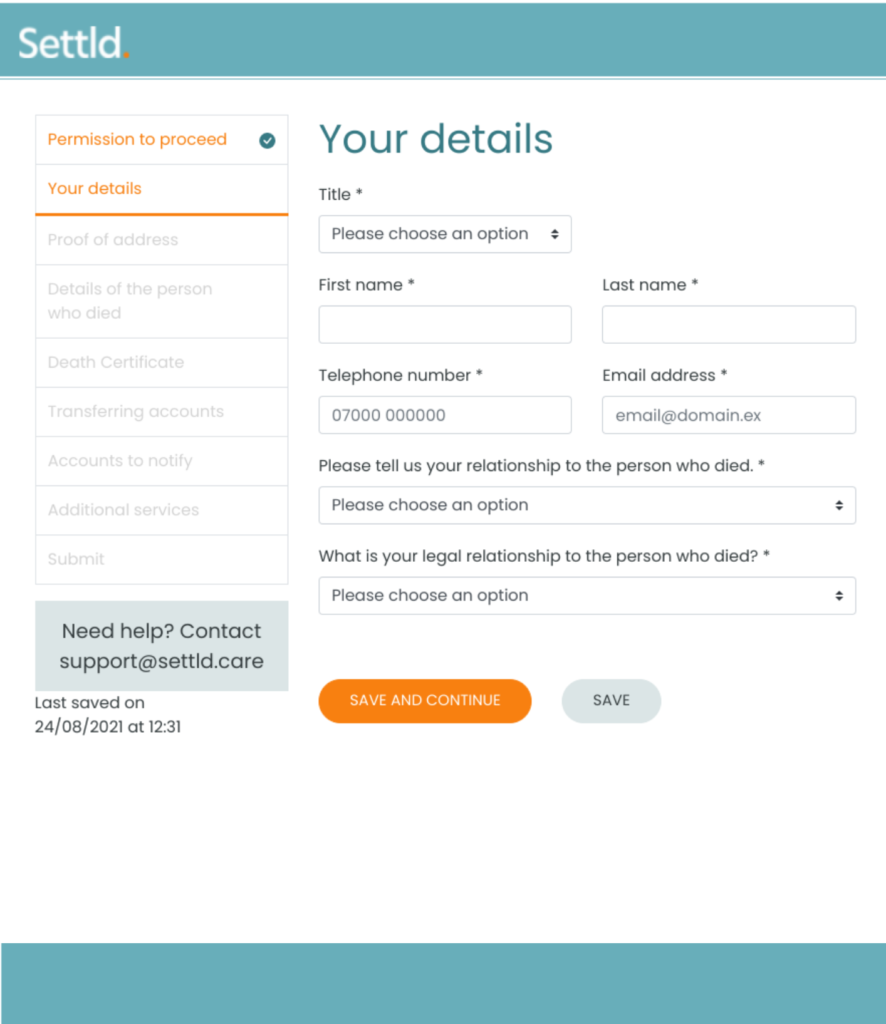

Once you have paid and created an account, you will receive an email to validate your details for security reasons. Click the link in the email and follow the step by step guide on each page.

Consent When you start the form, you’ll be asked to give Settld permission to notify companies on your behalf. You’ll then need to provide your details, details of the person who has died, and the contact details of any other Executors/Administrators of the estate.

Accounts You’ll be able to select all of the accounts you want to notify and add them one by one. There is no limit to the number of accounts you can add.

Documents We’ll ask you to provide scans or photographs of the documents that your listed companies ask for.

Fraud check Once you have completed the form, you will be asked to complete an identity check. You must do this in order for us to start processing your notification.

Please note:

- You can save progress at any point and return to the form later

- Once you’ve submitted the form you can go back and add more accounts or select from additional support services

- Settld is constantly updated so you can check the progress of your accounts at any time in your personal accounts dashboard.

These are the documents we always need:

- Death Certificate (if this is not available, the Interim Coroner’s Certificate)

- Proof of your identity: your passport, driving licence or residency card

These are the documents we may need, depending on the service provider:

- A Will, if one exists. You’ll need to upload the title page, the page with the Executor details and the signature page

- Proof of your address. A recent utility bill is preferred, but a council tax bill is also acceptable. If you don’t have either of these, a credit card, bank or building society statement issued in the last 3 months will also be accepted by most companies

For any documentation required, please upload either a scanned copy or a photograph. Photographs should be clear and capture the information clearly – we won’t be able to work with blurry images.

We will also ask you to provide additional information about the person who died, as part of the Probate application.

Whilst every Service Provider has different rules, many financial institutions require a certified copy of the death certificate to act as proof of death when closing accounts. These cost £11 each and are typically not returned to you once completed. Settld always attempts to use a digital channel to correspond with Service Providers, therefore reducing the number of certified copies of death certificates you would require.

- Account numbers (if you have them)

- Customer reference numbers (if you have them)

These details often are not mandatory, but they do help Service Providers to respond faster. Most companies will be able to find the account using the full name of the person who died, their registered address on the account, and their date of birth.

We ask for a picture or scan of the original Death Certificate because a lot of companies require this for their records. The death must be matched against the General Register Office (GRO) data, to prove the death happened and prevent fraud. If you have not received the death certificate yet, please upload the Coroner’s Interim Certificate.

Please note that some companies request a physical death certificate to be posted to them. In that case, we will let you know the address to send it to.

This ensures that you, and the Service Providers we notify, are protected against fraud. The identity verification provider with whom we work (Onfido), will verify that your identity documents are authentic and have not been stolen or tampered with. We only ever send these details to Service Providers who actively request them (normally financial institutions). Otherwise, your data remains locked safely in SOC 2 Type II and ISO 27001 digital vaults.

In this case, please upload either an HMRC tax notification (dated within the last 12 months) or a benefit entitlement letter (dated within the last 12 months) confirming the benefit you’re receiving at the time of issue.

If you don’t have a Council Tax Bill or Utility Bill in your name, most companies accept these other documents as proof of address:

- Credit Card Statement (issued within the last 3 months)

- Bank Statement (issued within the last 3 months)

- Building Society Statement (issued within the last 3 months)

If there is a written Will, it is best to upload it. We will only ever send the Will out to Service Providers who ask for it as part of the Probate process (normally financial institutions). Sometimes Service Providers will want to check the details of the Executors listed in the Will, as they are the point of contact for settling outstanding credit or debt against each account. For Service Providers who do not request or need it, we do not send it out.

Yes. In this case, the Settld form will ask you to obtain permission to proceed from the next of kin or the named Executor (if there is a Will). They will be asked to sign a short form, saying that they are happy for you to act on their behalf. Settld will not be able to notify any companies, without this information.

Yes. Settld is compliant with all data laws and requirements. We use industry best practices to ensure data security in storage and transmission. We run our service on cloud based products that have the highest privacy and security protection. Onfido, the identity verification provider that we work with, is used to verify that your documents are authentic and have not been stolen or tampered with.

Settld is an intermediary and not a legal firm. However, we are formally supported by the Law Society, and part of the Barclays Bank Legal Tech program.

Please call us on 0333 111 1111 or email support@settld.care. One of our support agents will be happy to assist you.

Settld informs any non-government organisation of a death in one go, and handles the closure or transfer of accounts (from banks to social media providers) in one secure place. We also provide guidance and links to other services you may need, such as Probate, property clearance and local grief support.

Consistently rated a 5 Star Service

Helpful, patient and supportive

at a difficult time

A much needed service

saving time consuming administration

Thorough and professional

throughout the whole process

Ready to get started?

If you have further questions, please email support@settld.care

alternatively, you can call us on 0333 111 1111 (office hours are 10am-6pm Monday to Friday)